USD/JPY popped beyond 114, as traders priced in almost a “firm deal” on Federal Reserve rate hike in March. Will USD/JPY go beyond 115?

We have seen quite a fair amount of volatility in the currency market recently. We can expect more volatility for the rest of March and here are the 3 reasons why.

#1 Fed Rate Hike

There was a wild swing in rate hike expectation. Based on the Fed fund futures, the chance of rate hike in March is 90%, a giant leap from 40% a week ago. The switch in market sentiment is due to the conscious effort of Fed officials highlighting rate hike in March is highly possible over and over again. The final call will be made in the upcoming FOMC meeting next week. If there is a major upset in the non-farm payroll and/or other jobs data at the end of this week, then there could be a sell-off in the dollar. Otherwise, we expect the rate hike expectation to remain.

#2 Theresa May Invoking Article 50

UK Prime Minister Theresa May is on track to invoke Article 50 by the end of March. GBP/USD broke 1.24 and hit a 6-week low on Fed rate hike expectation. Brexit is nothing new, however the effect of it on the economy remains unknown and uncertainty breeds fear. Possibility of a second Scottish referendum for independence adds another variable to the equation. Although Scotland accounts for only 6% of UK GDP and 8% of UK population, but a possibility of Scotland leaving UK is enough to justify a short in the sterling. The GBP/USD is like a face-off between a weak opponent against a strong one, we expect the currency pair to remain under pressure.

#3 Europe Elections

Next week’s Dutch election marks the start of a series of elections in Europe. This could give us a fair gauge on the populist strength and anti-EU sentiment in Europe. If the result indicates a growing anti-EU sentiment, it may overflow to the French presidential election in April. France is the second largest economy in EU, one of the candidates Marine Le Pen is an anti-EU populist. At the moment, polls are not showing she is gaining traction. We believe the game is still open from now until April. If Le Pen starts to gain traction over other candidates, then it could spell trouble for the euro. European Central Bank (ECB) will announce their interest rate and have a press conference this Thursday. We expect Mario Draghi to acknowledge the growth in economy, but continue to remain cautious in view of political uncertainties ahead.

Our Picks

GBP/USD – Bearish. Fed rate hike expectation and UK political uncertainty continue to exert pressure. Consider looking for short entry when the Stochastic goes above 80 to give a sell signal.

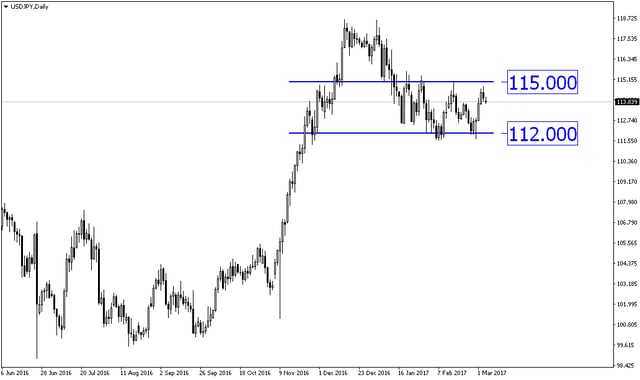

USD/JPY – Bullish. We expect this pair to test the 115 level ahead of next week’s FOMC.

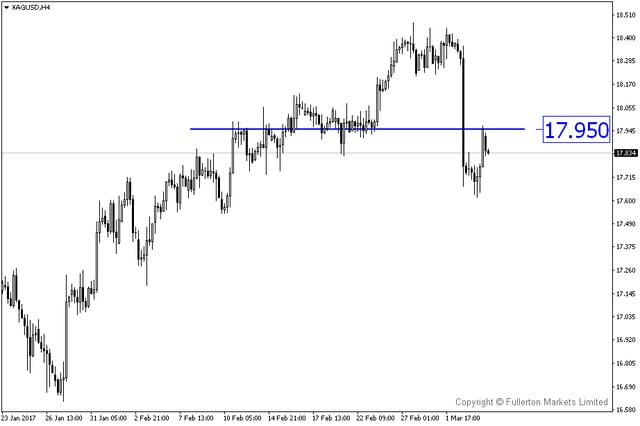

XAG/USD (Silver) – Bearish. Silver broke a new low, indicating bearish momentum. Consider going short riding on the strength of dollar.

Top News This Week (GMT+8 time zone)

Australia: Cash Rate. Tuesday 7th March, 11.30am.

We expect figures to remain unchanged at 1.5% (previous figure was 1.5%).

Europe: Minimum Bid Rate. Thursday 9th March, 8.45pm.

We expect figures to remain unchanged at 0.0% (previous figure was 0.0%).

US: Non-farm Payroll. Friday 10th March, 9.30pm.

We expect figures to come in at 180K (previous figure was 227K).

Fullerton Markets Research Team

Your Committed Trading Partner