With Australia’s job market edging towards full employment, Short GBP/AUD?

Australia’s jobless rate fell to a 6-year low, pushing the economy towards full employment level which the central bank is targeting. Unemployment rate came in at 5.3% versus 5.4% in June. This was partly due to a declining participation rate which fell to 65.5%, down from 65.7% last month.

However, total employment in Australia fell to 3,900 in July, a huge miss from the forecast of 15,000. The reversal is solely due to the falling part-time work which was down 23,000, while more than 19,000 full-time jobs were created.

Though the data may seem mixed, we feel that the latest data suggest the underlying health of Australia’s economy remains healthy. Moreover, with the gradual decline in unemployment rate, the full-time employment growth should reduce the level of labour underutilisation in no time.

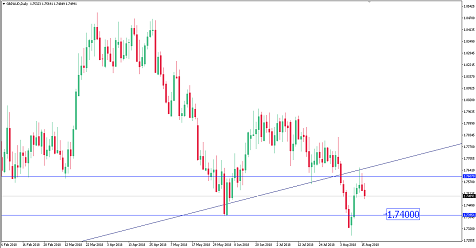

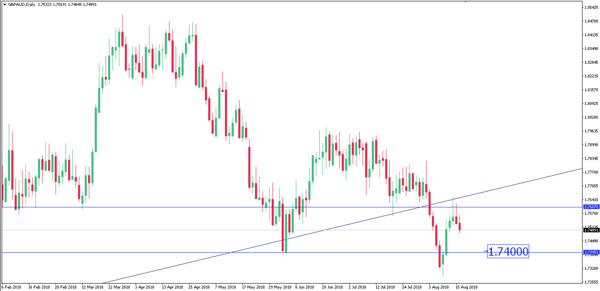

The Australian dollar rose by 0.4% following the release of the jobs data. We saw GBP/AUD breaking lower after getting rejected off the resistance at 1.7620 price regions. With selling pressure on sterling still overwhelming economic data, we could see more downside for this pair.

Fullerton Markets Research Team

Your Committed Trading Partner