Apple’s outlook cut due to weakening iPhone demand added to worries about a slowing global growth; we could long gold as funds start to flow into safe-havens

A “flash-crash” happened just before 6.30am (SGT) this morning when yen surged to new highs in minutes. We saw the largest movement in AUD/JPY whereby this pair fell by 8% to a 2009 low while yen rose at least 1% versus the rest of the G10 currencies.

Japanese Yen spot strengthened from 108.80 to 105.11 within 20 minutes:

-Oct-20-2022-05-38-46-75-AM.png?width=600&name=Breaking%20News%2020190103%20(%231)-Oct-20-2022-05-38-46-75-AM.png)

The change to a risk-on environment was due to a surprise revenue warning from Apple Inc, which added worries to the already slowing global growth. The spike in risk aversion triggered massive stop-loss flows from investors who held short positions on yen. In addition, a lack of liquidity due to Japan still on holiday after the New Year added to the sharp surge.

Even though the sudden surge in yen came as a surprise, we believe in the longer term there are other reasons for yen to rise:

- The US-China trade war continues and if Trump were to slap additional tariffs on China after the truce, it could hurt the global trade market.

- The equity market weakness is still recovering and with Apple’s sales outlook cut, this could add to worries about fading global demand.

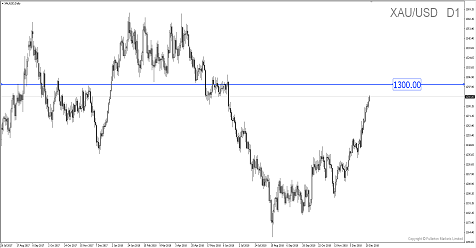

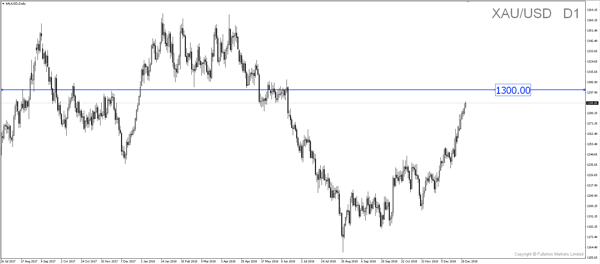

The ‘flash-crash” seen this morning was primarily driven by technical factors and not fundamental. This could mean that we could see a slow retracement for yen in the short term. Our best bet will be gold as the upward momentum remains strong. Gold could continue to rise towards the 1300 level before facing any strong resistance.

Fullerton Markets Research Team

Your Committed Trading Partner