Editor’s Note: This post was originally published on February 7, 2019, and has been updated for comprehensiveness.

While losing one or two forex trades is normal, losing five or six in a row can completely destabilise your trading. But even the most successful traders have more losing trades than winning trades in any given year, which indicates a loss is just a part of the system.

The key is to maximise profits on the winning trades and minimise losses on the losing ones. You should also develop the right attitude of a successful trader.

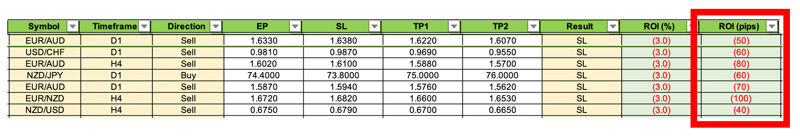

The Graphic of Continuously Losing Trades

The Graphic of Continuously Losing Trades

Here, we discuss a few tips on coping with losing streaks, as shared by some of the best in the business:

Keep a Detailed Trading Diary and Understand Trading Statistics

First, let’s talk about journalling.

Think of a trade journal as a map of your journey to sustained successful trading, which can only happen if you keep a log of all your trading activities, complete with a record of the emotions involved.

By keeping track of everything that happens before, during, and after you execute a trade, you will be able to evaluate your performance objectively. The details you’ve logged will also help you:

- Develop and execute a good trading plan

- Identify a trading system that matches your goals and plans

- Review your performance so you can improve where necessary and avoid mistakes

- Build discipline to follow your trading plan no matter what

In other words, it's how you'll know where you're good at and where you suck when trading Forex.

Successful journalling, however, is more than just listing down your entry and exit points. You also need to provide details on why you choose to enter a particular point, how you got out, and why your trade turned out the way it did.

It's important that you write everything down with complete honesty. Don't leave anything out. You should also include your observations of the Forex market, so you don't focus solely on self-analysis.

After a couple of months of keeping a trading diary, you'll be able to see patterns and setups you want to trade. The data you've accumulated will also guide you to understand your trading statistics and what you should and shouldn’t do to be a great trader.

Below are some of the points to include in your trading journal.

So what’s the link between a trade journal and your win rate?

A good trading diary allows you to track your trades and find the common thread among your losers and winners. This makes it easier for you to make the proper adjustments based on a win rate that is calculated according to your logged trading activities.

Because here's the thing about a winning rate: it could take on many forms. A 50% win rate, for example, can be:

Alternate - a win followed by a loss and then a win again

Consecutive - for example, five wins followed by five losses and vice versa

Per-profit - your profit from your winners is higher than your losses on your losers

While all these fall under a 50% win rate, a longer losing and winning streak can drive you to abandon your trading plans. You may be happy with a longer upswing period but the opposite will be hard to endure. Sure, the probabilities are the same whether you win seven of your trades and then lose the next seven but your mind would think otherwise.

It's best to have a system where a few consecutive losses is not a big deal, especially when you look at it from a wider perspective. We’ve seen veteran traders who’ve experienced a losing streak of 30 losses before winning and are still profitable at the end of the year.

It’s usually better to stick to a well-established and tested plan through a losing streak, rather than trying to fix it. Of course, make sure the conditions are favourable to the strategy that you’re using. Know when not to trade and choose your trades wisely.

Take a Break

Take a breather, take your mind off trading for a bit if you must, and gather yourself. As long as your losing streak is not a result of you trading randomly or changing your plans, you'll surely bounce back. You just need to take a day off or two to refocus and stop bleeding money.

Have a cup of coffee while you're taking a break

Once you gain perspective, you'll realise that your losses are not that big of a deal. Just remember not to run away every time you have a few losers. You must learn to accept the losses with the wins in Forex trading.

You might want to "wait for the winner" as well. That is, after losing five trades in a row, you don't trade the next signal and only restart once a winner occurs. This signals that the market is working favourably to your strategy again.

Just like taking breaks after a losing streak, however, take caution when waiting for the winner. Use it sparingly so you don't end up afraid every time you lose.

Do Not Go for Home Run Plays

It isn’t uncommon for traders to do almost anything to recoup their losses in the market but do little about improving their mental or emotional performance. This makes revenge trading such a huge problem.

Oftentimes, it's a result of pride, greed, anger, and stress. You've invested a lot of time and effort in the market, why did you get stopped out by 1 pip? You were so sure that was a winning trade but the opposite happened.

Because of your anger and frustration, you'll overtrade, go on tilt or chase on your subsequent trades to get back at the market. This can lead you to disregard your rules and behave irrationally. You could lose your entire account once you’ve come to your senses.

But the most devastating effect?

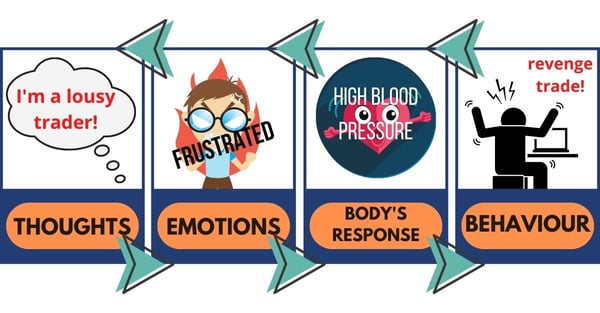

You could get trapped in the vicious cycle of a losing streak where your thoughts and emotions can affect your body and behaviour.

It all starts with damaging thoughts that can lead to feelings of anger and disappointment. This can then lead to a physical response--your muscles tighten and your blood pressure elevates. As a results, you’d want to take out your frustration on the Forex market.

When you end up with a loss, the same cycle starts all over again.

The best course of action is to be aware of the emotions and thoughts that have emerged following a loss. Make sure they don't affect your next trading decision and that you act according to your goals.

So the moment you feel like you want to go all in despite several losses, we advise you to do just the opposite.

Your goal now is to preserve your capital until you regain your confidence and winning form. So trade conservatively until such time that you can afford to get in with the same allocation as you did before you had a string of bad trades.

Trade through the Losses

This may sound foolhardy but when you face a losing streak, you have to trade through it without adjusting your methods. Doing so will develop your ability to remain consistent regardless of the outcome of your trades.

In Forex, consistent trading is the key to success. It will shape you as a trader and keep you from under or overtrading. It will also help you create a consistent trading plan that will enable you to trade under various market conditions.

One way you can develop consistency is by relentlessly taking advantage of your strategy's edge. Thus, the need to trade through a losing streak. Again, be wise in making this move.

Then, take a look at your trading activities and review each one to identify bad trades and strong areas. This is how you'll identify the edge of your trading strategy.

If you want to perfect it, make sure to test, record, review, and repeat. Follow the same pattern if you want to try a new strategy.

What if you're a less experienced trader? Start with a demo account and test your strategy out for several months. If it works, then it works. Trust that it will help you win, but set boundaries:

- Risk no more than 1% of your capital per trade

- Trade using the same method for at least two losing streaks

- Continue to trade even after two strings of losses

If you make a profit after doing so, keep trading it. Otherwise, test a different strategy.

Another thing that will help you remain steadfast despite the consecutive losses is to think like a casino manager. They know that the tides will turn in their favour given enough time. It's a matter of letting the odds play out.

Bottom Line

In order to trade profitably, you must enter with a positive state of mind. This means accepting that anything can happen in the market at any time.

If you've just taken a big hit, stop trading for a couple of days. You aren't in the right headspace to make proper decisions anyway. Assess your trading plan and your trades. Identify the problems and make any necessary changes to your plan. Trade using a demo account for a few sessions to help build your confidence. Only switch to live trading once you’ve had a few profitable days and are feeling more like your old, successful self. Keep position sizes small for the first few days after switching to live trading.

Implement these 7 Strategies to Help You Bounce Back from a Losing Streak in Forex

Remember that making money isn't the main goal. Instead, look to build confidence and implement your plan well. If things go favourably, then slowly increase the position size back to your normal amount (for most traders, that is 1-3% or less of their trading capital).

Ready to to test your newfound knowledge and grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: The 3 Laws of Successful Trading