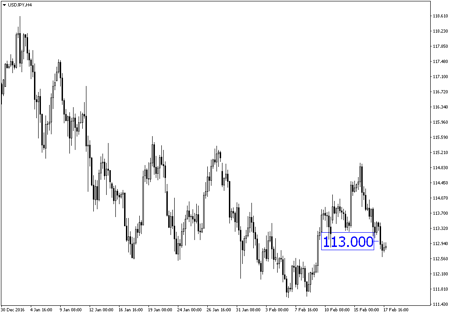

Once again, market has proven to be irrational. Fed Chair Janet Yellen’s hawkish comments and positive US data failed to inspire the dollar bull. USD/JPY ended last week below 113.

US Producer Price Index (PPI), Consumer Price Index (CPI), Retail Sales and Unemployment Claims, every single piece of data outperformed expectation. So why did USD/JPY weaken towards the end of last week?

In the first semi-annual monetary policy report, Yellen reinforced Fed’s tightening plan and setting rate hikes expectation in 2017. Yellen’s comments were more hawkish than what the market had anticipated. They were in line with what we had expected, keeping rate hike alive, but not “over-promising” (refer the last week’s research). We have to ask again, so why did USD/JPY weaken towards the end of last week?

USD/JPY tracks the US treasury yield closely. Both the 10-year yield and 30-year yield dropped towards end of last week, explaining the drop in USD/JPY as well. Data have given Fed more reasons to raise rate soon and Fed is not shy of expressing their concern if it waits too long to tighten. There are not much US data in the upcoming week. The FOMC Meeting Minutes are likely to reflect similar hawkish sentiment. If there is clear indication of the next rate hike, we could expect USD/JPY to climb towards 114 or beyond.

UK feeling the heat

The picture is not so pretty across the Atlantic. UK CPI and Average Earnings underperformed. Although Claimant Claim outperformed expectation by a big margin (-42.4K versus 1.1K), but it was based on a new measuring method by the Office for National Statistics (ONS). The most recent PMIs underperformed as well. These reasons ease some tightening pressure off Bank of England for the time being and sterling is likely to remain under pressure this week. If the second estimate GDP surprises to the downside, we would expect sterling to go through another round of sell-off.

We do not expect any surprise from Australia Monetary Policy Meeting Minutes and FOMC Meeting Minutes. With only a handful of data releasing this week, it could favour technical play for traders.

Our Picks

AUD/NZD – Consolidation. We do not expect surprises from RBA meeting minutes and AUD/NZD is likely to trade within 1.0700 and 1.0640.

USD/JPY – Bullish. Fed’s intention and data are supporting the dollar fundamentally. We expect 113 to hold for this week.

XAU/USD (Gold) – Bullish. Gold is trading between 1222 and 1243. Consider going Long around 1231 or 1222.

Top News This Week (GMT+8 time zone)

UK: Second Estimate GDP q/q. Wednesday 22nd February, 5.30pm.

We expect figures to come in at 0.6% (previous figure was 0.6%).

Canada: Core Retail Sales m/m. Wednesday 22nd February, 9.30pm.

We expect figures to come in at 0.6% (previous figure was 0.1%).

Canada: CPI m/m. Friday 24th February, 9.30pm.

We expect figures to come in at 0.2% (previous figure was -0.2%).

Fullerton Markets Research Team

Your Committed Trading Partner