The recent dip in the Dow Jones Industrial Average amid concerns over banking issues does not necessarily foreshadow a significant drop below multi-year lows. The volatility in the banking sector will help the Federal Reserve's mission of cooling down the economy. Regional lenders are going to have to constrain capital. That said, the money isn't going to be flowing through the system nearly as easily in the back half of this year and that indirectly is going to cool down the economy, which is ultimately going to do the Fed's job by bringing inflation down.

JP Morgan: The “Too Big To Fail” Bank Benefits Amidst Banking Crisis

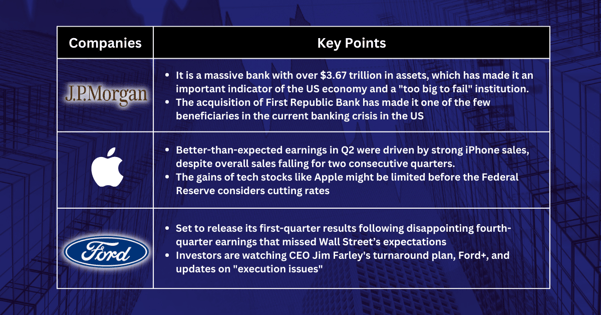

JP Morgan has a staggering $3.67 trillion in assets, not accounting for its latest acquisition, First Republic Bank. The bank's size has made it a bellwether for the US economy and an entity that's “too big to fail”. However, some are concerned that JPMorgan's continued intervention during times of crisis has broader implications for the banking sector, the US financial system, and its regulation. JPMorgan’s acquisition of First Republic Bank has made it one of the few beneficiaries in the current banking crisis in the US.

Apple Reports Better-than-Expected Earnings Amidst Economic Slowdown Risks

Apple has reported better-than-expected second-fiscal quarter earnings, driven by stronger-than-anticipated iPhone sales. The company’s overall sales fell for the second quarter in a row, and demand for these products is expected to further decline as global economic activities slow down. Apple CEO Tim Cook said that the quarter was "better than we expected." However, before the Federal Reserve considers cutting rates, the gains of tech stocks, including Apple, might be limited. Highlighting Apple's report was iPhone sales, which grew from the year-ago quarter even as the broader smartphone industry contracted nearly 15% during the same time.

Ford Looks to Regain Investor Confidence with First-Quarter Results

Ford Motor is set to release its first-quarter results following disappointing fourth-quarter earnings that missed Wall Street’s expectations, and its 2022 earnings falling short of the company's full-year guidance. The automaker has been under increasing pressure to show that a turnaround plan led by CEO Jim Farley, called Ford+, is taking hold. Investors will closely watch the automaker’s progress regarding the turnaround plan and any updates on correcting “execution issues” that Farley outlined to investors earlier this year.

Fullerton Markets Research Team

Your Committed Trading Partner