US stocks continue to ride high after a strong May jobs report and the Congress passing a debt ceiling bill. However, investors are wary of the narrowness of the rally, with some shifting towards undervalued and cyclical stocks. All eyes are now on the Federal Reserve's upcoming policy meeting on 13 and 14 June as it navigates inflation concerns and decides on interest rates, which will have significant implications for the market.

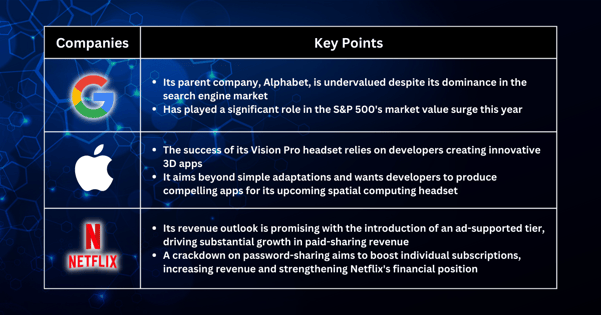

Google, the search engine giant, has played a major role in the S&P 500's market value surge this year. While stocks like Apple, Nvidia, and Broadcom have contributed significantly, there are concerns about their potentially overvalued status. Conversely, Alphabet, Google's parent company, stands out as an undervalued stock among the top market-value drivers, despite its strong performance and dominance in the search engine market.

Apple recently unveiled its Vision Pro "spatial computing" headset, aiming to launch in early 2024. The company's success now hinges on convincing developers to create compelling apps for the headset. While the hardware is not widely available yet, Apple is eager for developers to go beyond simple adaptations and produce innovative 3D apps that were previously unimaginable on other devices.

Netflix's revenue outlook appears promising, with forecasts predicting substantial growth in paid sharing revenue. By 2025, the company is expected to generate $3.5 billion in total paid-sharing revenue, driven by the introduction of an ad-supported tier and a crackdown on password-sharing. The ad-supported tier will expand Netflix's reach to a bigger audience, while the password-sharing crackdown aims to encourage individual subscriptions, ultimately boosting revenue and strengthening the company's financial position.

Fullerton Markets Research Team

Your Committed Trading Partner