US stocks fell Friday but notched a positive week as investors assessed a weak retail sales report that dented enthusiasm around a stronger-than-expected start to corporate earnings.

Retail sales in March showed consumer spending fell twice as much as expected. Retail sales declined by 1% last month, more than the 0.5% drop expected, in part because consumers paid less for fuel.

Inflation has been coming down as gas prices have been decreasing, but that can reverse immediately, which would drive the headline numbers higher. What is more concerning is that core (which excludes food and gas prices) has been stubbornly high, and where we believe the risks of “higher for longer” rates lie.

Expectations for this earnings season are downbeat. Analysts expect S&P 500 earnings to fall more than 5% in the first quarter. That forecast comes as companies deal with persistent inflation and higher rates.

What is going to be super important is the kind of guidance we get and how confident that corporations will be in guiding for the next three quarters in the face of what likely will be a slower economy.

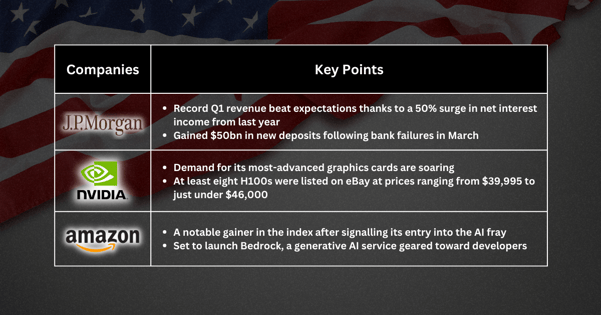

JP Morgan: Being benefitted amid a banking crisis.

Megabanks in the US became attractive. JPMorgan Chase posted record first-quarter revenue on Friday that topped analysts’ expectations as net interest income surged almost 50% from a year ago on higher rates.

JPMorgan estimated Friday that it picked up about $50 billion in new deposits following March’s bank failures, though executives cautioned that they might not stick.

Its finance chief said Citigroup attracted nearly $30 billion in deposits in those weeks, mostly from midsize businesses. Wells Fargo also said it gained several deposits.

JPMorgan’s net interest income—what it makes on loans minus what it pays depositors—rose 49% to a record $20.71 billion.

Demand for Nvidia’s chip is soaring.

Nvidia’s most-advanced graphics cards are selling for more than $40,000 on eBay as demand soars for chips needed to train and deploy artificial intelligence software.

On Friday, at least eight H100s were listed on eBay at prices ranging from $39,995 to just under $46,000. Some retailers have offered it in the past for around $36,000. The H100, announced last year, is Nvidia’s latest flagship AI chip, succeeding the A100, a roughly $10,000 chip called the “workhorse” for AI applications.

Amazon shares to be benefitted from its entry into AI territory.

Amazon shares contributed to a solid performance by the Nasdaq Composite recently. The tech giant was a notable gainer in the index after signalling its entry into the AI fray.

Amazon Web Services announced it would launch Bedrock, a generative AI service geared toward developers.

Fullerton Markets Research Team

Your Committed Trading Partner