Major US stock indices achieved substantial gains in a week marked by positive news. The rise was primarily fuelled by the success of prominent banks in passing the Federal Reserve's stress test and a favourable revision of GDP figures, which eased concerns about a potential recession.

Financial giants JPMorgan Chase and Goldman Sachs led the charge, witnessing stock price increases of over 3%, with Wells Fargo also making impressive gains of 4.5%. This followed the Federal Reserve's announcement that all 23 financial institutions included in its stress test were adequately capitalised to withstand severe recessions.

Positive economic data released throughout the week further boosted confidence in the resilience of the US economy. Notably, there was a significant upward revision of first-quarter GDP figures, indicating stronger economic performance than previously estimated. Additionally, weekly jobless claims reached their lowest level since May, indicating a robust labour market.

The stress tests conducted by the Federal Reserve reassured investors that banks are now better equipped to handle economic downturns than before the 2008 financial crisis. This revelation further enhanced investor sentiment and contributed to the overall market rally.

As the trading week concludes, the S&P 500 index has achieved an impressive 14.5% gain this year, positioning it for its best monthly performance since January. The technology-focused Nasdaq index has been remarkable, surging nearly 30% and heading towards its strongest first half since 1983. This surge can be attributed to growing optimism surrounding artificial intelligence, which has propelled technology stocks to new heights. However, the blue-chip Dow index has lagged, posting a modest increase of just 2.9%.

Despite the strong start to the year, investors should brace themselves for potential volatility in the second half. It is crucial to remember that market trends are not always linear, and periods of consolidation are not uncommon. Considering this, investors may consider utilising strategies involving volatility or safe-haven assets as they position themselves for a broad-based recovery.

AI Stocks: Time to retreat?

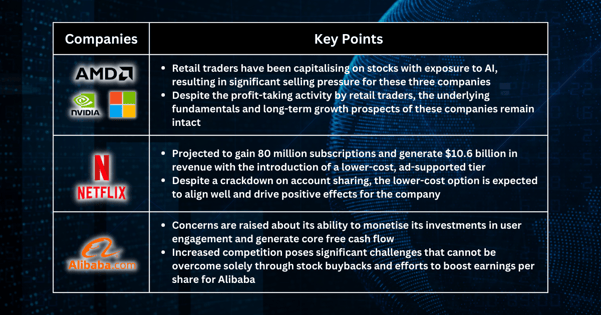

According to JPMorgan, retail traders have made notable moves in the past week by capitalising on stocks with exposure to artificial intelligence (AI). This trend is reflected in the net difference between buying and selling activities by retail investors.

One stock experiencing significant selling pressure is AMD, with retail traders offloading approximately $648 million worth of shares. Nvidia, another prominent player in the AI space, also saw a net loss of $106 million as retail investors decided to cash in on their gains. Similarly, Microsoft, actively involved in AI development, witnessed a net outflow of $92 million from retail traders.

These three companies have enjoyed substantial rallies in recent months, driven by AI technology's increasing excitement. As AI gains prominence across various industries, investors have flocked to companies leading the way in this transformative field. However, retail traders have adopted a more cautious approach in the past week, securing their profits after witnessing significant gains.

This move by retail traders reflects a common market phenomenon where investors sell holdings or take profits when they perceive a stock to be overvalued or anticipate a potential downward correction. It is important to note that retail traders often have a shorter investment horizon compared to institutional investors, making them more susceptible to short-term market movements and sentiment-driven decisions.

While the profit-taking activity by retail traders may indicate a temporary pause or slight pullback for these AI-related stocks, it does not necessarily imply a bearish outlook for the companies or the broader AI sector. The underlying fundamentals and long-term growth prospects of these companies remain intact, and the recent sell-off could present an opportunity for new investors to enter the market or for existing investors to add to their positions at potentially more attractive prices.

Netflix: Ad-enabled subscription option may boost shares

Netflix is projected to gain an additional 80 million subscriptions with the introduction of its lower-cost, ad-supported tier. This surge in subscribers is expected to generate approximately $10.6 billion in increased revenue for the company, surpassing the earlier forecast of 66 million subscriptions made in September 2022.

The ad tier is priced at $6.99 per month, $3 cheaper than Netflix's "basic" plan, which is the next most affordable option available at launch. The company has stated that viewers can expect about four to five minutes of advertisements for every hour of content.

The strong demand for the ad tier has prompted analysts to raise their targets, despite the crackdown on account sharing without additional payment, which is not expected to significantly impact the stock positively. Netflix implemented this crackdown in the United States in May after implementing it in certain international markets earlier this year.

The introduction of the lower-cost option and the crackdown on account sharing are believed to align well together. As sharing becomes more difficult, consumers are more likely to opt for cheaper plans, resulting in an overall positive effect on the company.

Looking ahead to the second-quarter earnings report, analysts anticipate meaningful updates regarding the performance of the ad tier since its launch. Positive commentary on the rollout is expected to drive stock prices higher.

Alibaba: Low growth outlook may pressure stock prices

We express concerns about Alibaba's strategy of investing in user time spent and engagement as some investors raise questions about the company's ability to monetize these efforts and generate core free cash flow.

Despite the relatively low valuation of Alibaba's stock, we believe that increased competition may pose significant challenges that cannot be overcome solely through stock buybacks and efforts to boost earnings per share.

While Alibaba has implemented share buybacks resulting in a 2.4% decrease in share count compared to the previous year, the future is a long-term consideration. We are sceptical that maintaining low multiples and achieving modest EPS accretion will be sufficient to drive sustainable growth in share price if the underlying competitive issues in core e-commerce remain unresolved.

Fullerton Markets Research Team

Your Committed Trading Partner